Whats Next For Singapore REITs In 2026

- Daniel Lee

- Dec 27, 2025

- 4 min read

2025 has been a year of stabilisation and rebound as the world ushers back a lower interest rate environment, which has improved investors' confidence on the back of better operating performances from a lowered borrowing cost.

Moving into 2026, here are my thoughts on what may transpire in the REIT market this year and a little insight as to what I am looking out for.

Increase investor demand in REITs

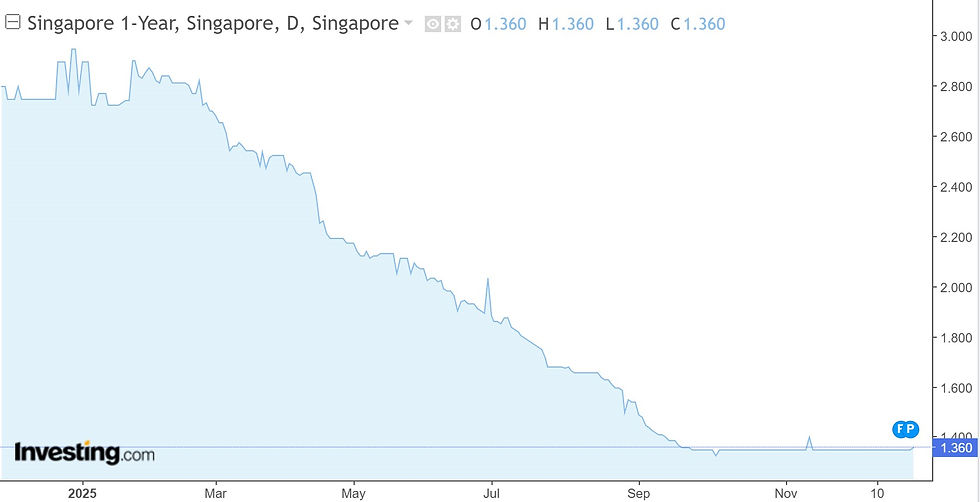

As the 1-year Singapore Treasury Yield tumbled from around 3% to the current 1.35%, we can expect more indiscriminate buying by retail investors moving into 2026 in pursuit of a higher yield on their savings.

The increase in demand for REITs will and is already pushing yields down to levels that don’t provide any margin of safety, especially for the well-managed REITs.

In fact, as of December 2025, the yields from operations from high-quality REITs today are already trading near 4% levels which is no different from the risk-free rate from the CPF special account.

A quick look at the “higher quality” REITs across the different industries already paints the picture that the current market may not be attractive, given the poor risk-to-reward trade-offs.

As the share prices of REITs continue to increase due to the higher demand from retail investors, long-term investors should tread carefully with their entry price, as a well-managed REIT is not a good investment if the price isn’t right.

Similar to why you would invest in Singapore Government Savings Bonds when the yield is at 3% instead of 1.35%, you should not invest in any REITs if the yield doesn’t justify the risk that we are exposed to as investors.

That said, all these are assuming that the global macroeconomic backdrop continues as it is today without any negative catalyst (i.e. escalation in war or economic recessions) that may trigger a global sell-down.

Divergence In Interest Rate Environment

While most of the global central banks have moved in the same direction from 2022 to 2024, divergences have been noted since the second half of 2025. This behaviour is expected to continue moving into 2026.

Looking at the major markets and their central banks’ behaviour, this is what I am expecting concerning the interest rate environment for 2026:

As the general borrowing cost has already come down in 2025, the impacts of the lower rate environment may continue into 2026. This will continue to feed into the current positive momentum, especially for REITs which had to refinance at a much higher rate during 2022 and 2023.

That said, moving forward, given the divergence of interest rate environment across the different major markets, the performance of the REITs may also be drastically different, assuming that other factors remain constant.

Industries I Am Watching

Having mentioned my expectations for FY2026, here’s a sneak peek into the industries I am closely monitoring and would trigger a trade should the price be right. (For clients, you can just refer to the trade blotter in the shared folder to see the exact counters and target price.)

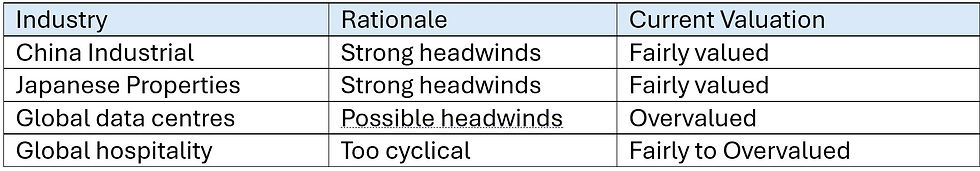

Conversely, the industries that I am putting off or actively avoiding unless the yield is highly attractive include:

Unfortunately, looking at the scene today, coupled with the expected inflow of funds from the retail demand, it is unlikely that the general prices of REITs will fall to levels that are attractive to start or increase a position without any external negative catalyst (i.e. recession).

If you’re a long-term investor who is investing in REITs for income generation and capital preservation, always remember that a good REIT =/= a good investment.

Your entry yield is what would make or break your long-term returns as the share price would always gravitate towards the fundamentals and dividend yield in the long run.

Read more: The Dilemma With Office REITs In Singapore

Conclusion

2026 is likely to be a positive year for the REIT market in general, provided that there are no negative catalysts in the global markets, driven by the positive impact of lower borrowing costs coupled with increased demand from retail participants.

That said, for long-term investors, the developments in 2026 are crucial to watch as it may result in a hugely polarised market where high-quality REITs are heavily overvalued while lower quality but passable REITs may trade in undervalued territory.

As such, 2026 offers a good opportunity for short-term traders to profit from the positive catalyst but may pose a threat to long-term investors who do not do their due diligence and merely follow the flow, as all unjustified short-term price actions will eventually be pulled by the gravitational force of the long-term fundamental performances.

If you would like to read my analyst report on Singapore Listed REITs, you can find them on my telegram channel:

*Join the channel → click on the channel name → under files → download the report you want!

If you would like to learn about REIT investing, you can find my entire methodology in my eBook: Retire With REITs here:

If you are looking for personalized financial advice, I offer a 1-to-1, fee-only consultation where you will receive personalized strategies to design, implement and manage a profitable REIT portfolio. You can find out more about it here:

Connect with me on social media platforms to receive updates on future content! You can also slide into my DMs if you have any questions :)

Disclaimer:

This article is meant to be the opinion of the author

This article is for information purposes only

This article should not be seen as financial advice

This advertisement has not been reviewed by the Monetary Authority of Singapore

![[Portfolio Updates] Fundsmith Equity: What's Next?](https://static.wixstatic.com/media/5dc7f7_4284779b2e1148219b3de63a154af0d0~mv2.png/v1/fill/w_443,h_250,fp_0.50_0.50,q_35,blur_30,enc_avif,quality_auto/5dc7f7_4284779b2e1148219b3de63a154af0d0~mv2.webp)

![[Portfolio Updates] Fundsmith Equity: What's Next?](https://static.wixstatic.com/media/5dc7f7_4284779b2e1148219b3de63a154af0d0~mv2.png/v1/fill/w_243,h_137,fp_0.50_0.50,q_95,enc_avif,quality_auto/5dc7f7_4284779b2e1148219b3de63a154af0d0~mv2.webp)

![[Portfolio Updates] 2025 Portfolio Review](https://static.wixstatic.com/media/5dc7f7_4b72a9e6866f4b5ca7e866ab26a91592~mv2.png/v1/fill/w_443,h_250,fp_0.50_0.50,q_35,blur_30,enc_avif,quality_auto/5dc7f7_4b72a9e6866f4b5ca7e866ab26a91592~mv2.webp)

![[Portfolio Updates] 2025 Portfolio Review](https://static.wixstatic.com/media/5dc7f7_4b72a9e6866f4b5ca7e866ab26a91592~mv2.png/v1/fill/w_243,h_137,fp_0.50_0.50,q_95,enc_avif,quality_auto/5dc7f7_4b72a9e6866f4b5ca7e866ab26a91592~mv2.webp)

Comments