[Portfolio Updates] Fundsmith Equity: What's Next?

- Daniel Lee

- Jan 18

- 7 min read

Updated: Jan 23

Having produced consistent levels of outperformance since its inception till 2021 Fundsmith’s recent performance post-COVID has been nothing like its former past.

Unfortunately, given that our portfolio was only incepted in 2021, this means that our experience with the fund thus far has been disappointing.

While I recognise the frustrations as an investor myself, I think it is important that we understand the source of the “problem”, what has changed and whether or not the fund still has a place in our portfolio instead of blindly selling off the fund and chasing after other funds which may have performed well in the last 2 years.

In this article, I will go more in-depth on the following topics

Understanding Fundsmith's Performance

To explain why Fundsmith performed the way it did, it is important to take a deeper look at the sectorial breakdown of the fund and examine how it has changed over the years and how it performs vis-à-vis the broader market environment.

Looking at the fund’s underlying constitution, we can identify the main reason why the fund’s performance detracted from the general market starting from 2023, and that is due to their overweight in defensive allocation in sectors such as health care and consumer staples and underweight in the Information Technology sector.

In a market driven by exuberance, Fundsmith’s current approach fell out of favour with the market preferences as investors are obsessed with the Information Technology sector, which has been making headlines daily regarding technological breakthrough (Generative AI) and record-breaking institutional investments into the space.

Compare that with the “boring” aspect of the defensive business sectors that Fundsmith allocates, it is no wonder that investors’ interest and funds are flowing towards the exciting sectors like Tech and away from the boring sectors, which has further propelled the disparity in short-term price actions.

If we were to take a closer look at what’s driving the returns in the general market, you would realise that despite the broadness of the S&P500, it is only a handful of companies that are driving most of the returns over the years, with the top 10 companies contributing roughly 50% of the index’s total return as of 2025.

If we were to look even deeper at the Magnificent 7 (Alphabet, Amazon, Apple, Tesla, Meta Platforms, Microsoft, and Nvidia) – which drives the returns of the Information Technology & Communication Services sector – we would realise that any fund that does not concentrate its position on this exposure will ultimately underperform the index.

While Fundsmith have a position in some of the Magnificent 7 that have a strong business moat whose main revenue source does not rely on the ongoing Artificial Intelligence hype, the non-exposure in the full 7 companies and the significantly lower allocation in the Information Technology sector is what causes the detraction in recent performances.

Now that we’ve made sense of what’s been driving the performance of the fund over the past few years, let's assess if Fundsmith’s current strategy makes sense.

Does The Current Strategy Make Sense?

Fundsmith's strategy is a long-term, buy-and-hold approach focused on investing in high-quality global businesses with durable competitive advantages, avoiding short-term trading, market timing, leverage, and derivatives, aiming for compounding growth by reinvesting profits from resilient companies.

Since its inception, the management’s style has been consistent, and the focus of the fund has remained relatively unchanged. That said, if we were to assess whether the Fund’s strategy makes sense based on the current investment climate, the answer largely depends on your focus and investment horizon.

If you’re in for a quick buck and ride the market exuberance, Fundsmith’s focus on quality businesses with strong fundamentals would not make sense in a market driven by narrative and investor demand instead of fundamentals. Instead, investing in momentum funds like the S&P 500 would be better until the climate flips.

However, if you are investing for the long term, Fundsmith’s strategy and focus would make more sense despite the lacklustre reception by investors.

As compared to the S&P500, Fundsmith portfolio consists of a much higher quality, resilient companies with durable business models, high returns on capital, strong cash generation, and minimal debt, then hold them for the long term.

For long-term investors, this discipline toward quality, durability, and capital efficiency is a feature, not a flaw. When the macro tide turns, whether through higher rates, slowing tech momentum, or broader market volatility, these fundamentals will matter again. And when they do, Fundsmith won’t have to reposition or scramble. It’ll already be where it needs to be.

In short: Fundsmith isn’t broken. The market’s mood is. And moods don’t last—quality does.

How Does Fundsmith Fit Into Our Portfolio Today?

In the previous two segments, we’ve taken a deep dive into Fundsmith’s performance and strategy in isolation. In this segment, we’ll be looking at how Fundsmith fit into our portfolio’s allocation today.

When it comes to our portfolio design, Fundsmith’s allocation is one that is not to be ignored, as it plays a crucial role when it comes to achieving proper portfolio diversification, specifically for the Western market component.

In a day and age where market concentrations in the Western markets are at their century-long all-time high, Fundsmith’s underlying allocation will help to offset this concentration risk and provide a much better diversification impact beyond what the remaining 490 companies within the S&P500 index have to offer.

This will help reduce the overall risk of our Western exposure within the portfolio and ensure that the portfolio is not too susceptible to any drawdowns or corrections in the Information Technology sector, which is currently propped up by hype and circular financing.

Read more: 2026 Market Outlook: High Risk High Reward

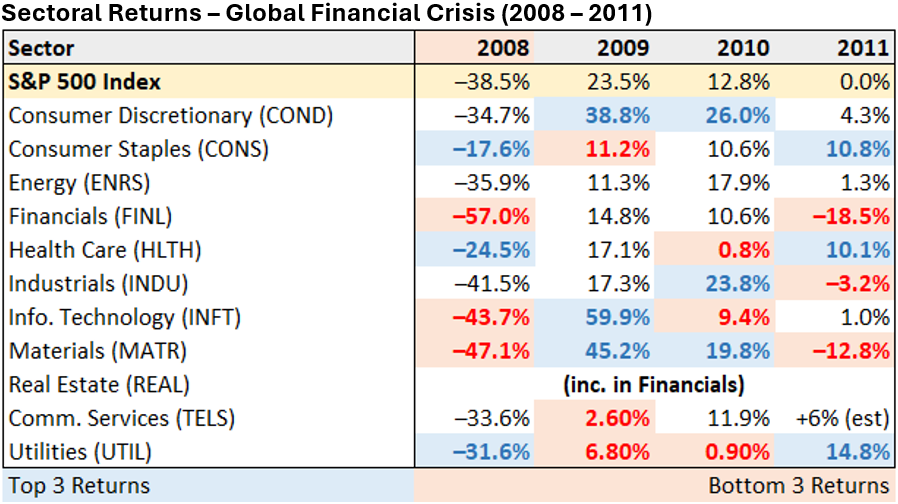

When (not if) the market regains its senses, when the valuations revert to their long-term mean, having Fundsmith’s underlying exposure would help cushion or even offset any drawdowns from the Information Technology sector through their defensive exposure, as we’ve seen based on the historical sectoral behaviour in the 2000 Dot Com Bust and 2008 Global Financial Crisis.

As such, from a portfolio design perspective, the question is not whether we should invest in S&P500 OR Fundsmith but rather how much allocation we should split between these two funds with very distinct underlying exposure and investment style.

You don’t pick Fundsmith instead of the S&P 500. You use it alongside to build in resilience, quality bias, and smoother long-term compounding. This is especially useful when index concentration risk becomes a concern, which is where we stand today.

Bottom Line: “You don’t fire your goalkeeper just because your striker scored three goals.”

In such an environment, Fundsmith plays defence while the S&P500 plays offence. That doesn’t matter - until it suddenly does.

This brings me to the final section of the analysis, which deals with the potential actions in the future.

Potential Actions In The Future

Like the experience and lessons drawn from our Asian exposure back in 2022 and 2023, the lesson that I’ve drawn from this episode is the risk and danger of being too favourable towards a specific type of management style or geographical/sectorial exposure – no matter how sound the analysis is or how confident I am in having the investment thesis play out in the long term.

As the popular saying goes:

The market can stay irrational longer than you can remain solvent

When it comes to portfolio management, I’ve decided to solely focus on controlling what we can control – i.e. ensuring that the fundamental quality of the funds that we invest in is sound – and avoid being affected by what we cannot control – investor preferences towards specific style, geography or sector in the short run.

As such, I’ll be looking to balance out the exposure between Fundsmith and the S&P500 to achieve a proper balance between the two distinct investment styles for our Western equity exposure.

Doing so would also even out any sectoral concentration that is found in either of the funds, therefore achieving a better balance between momentum and quality, which should, in theory, eliminate the impact of investor preferences.

In times where the market is exuberant, the underperformance of Fundsmith would be offset by the outperformance of the S&P. Similarly, when the market is adopting a more risk-off attitude, the outperformance of Fundsmith should offset the underperformance of the S&P.

That said, the timing of the adjustment is one thing that is still up for debate, as I don’t think it would make sense for us to trigger the adjustments right now when the S&P 500 is so hyped out, while Fundsmith, despite having a higher earnings quality & resilience, is being beaten down.

Adjusting today is akin to buying high and selling low, which doesn’t make sense despite the possibility for the market to continue being hyped up in 2026 and possibly 2027 (or until Trump's tenure is up and the market loses the governmental underwriter).

Long story short, when the market presents the opportunity, when valuations normalise between Fundsmith and the S&P 500, be it in the form of:

Better performance from Fundsmith

Poor performance from the S&P500

Mixture of both

I’ll then initiate the trade to make the necessary adjustment on the strategic allocation of our portfolio to achieve a balance between these two funds, such that we eliminate any impact investor preferences and biases may have in our portfolio, similar to what we’ve done for our Asian exposure back in 2023.

I hope this analysis has provided you with greater insight into what has transpired about Fundsmith Equity in the last few years, and while it is difficult to see the general market take off without Fundsmith, it is important for us to always fall back on why we decided to invest in the fund in the very first place.

Disclaimer:

This article is meant to be the opinion of the author

This article is for information purposes only

This article should not be seen as financial advice

This advertisement has not been reviewed by the Monetary Authority of Singapore

![[Portfolio Updates] Fundsmith Equity: What's Next?](https://static.wixstatic.com/media/5dc7f7_4284779b2e1148219b3de63a154af0d0~mv2.png/v1/fill/w_443,h_250,fp_0.50_0.50,q_35,blur_30,enc_avif,quality_auto/5dc7f7_4284779b2e1148219b3de63a154af0d0~mv2.webp)

![[Portfolio Updates] Fundsmith Equity: What's Next?](https://static.wixstatic.com/media/5dc7f7_4284779b2e1148219b3de63a154af0d0~mv2.png/v1/fill/w_243,h_137,fp_0.50_0.50,q_95,enc_avif,quality_auto/5dc7f7_4284779b2e1148219b3de63a154af0d0~mv2.webp)

![[Portfolio Updates] 2025 Portfolio Review](https://static.wixstatic.com/media/5dc7f7_4b72a9e6866f4b5ca7e866ab26a91592~mv2.png/v1/fill/w_443,h_250,fp_0.50_0.50,q_35,blur_30,enc_avif,quality_auto/5dc7f7_4b72a9e6866f4b5ca7e866ab26a91592~mv2.webp)

![[Portfolio Updates] 2025 Portfolio Review](https://static.wixstatic.com/media/5dc7f7_4b72a9e6866f4b5ca7e866ab26a91592~mv2.png/v1/fill/w_243,h_137,fp_0.50_0.50,q_95,enc_avif,quality_auto/5dc7f7_4b72a9e6866f4b5ca7e866ab26a91592~mv2.webp)

Comments