[Portfolio Updates] 2025 Portfolio Review

- Daniel Lee

- Jan 1

- 7 min read

Updated: Jan 2

If there’s a way to describe the markets in 2025, the word would be a Roller Coaster Ride.

2025 marks the year when the old rules that govern the global economy become invalid with the launch of Donald Trump’s trade war 2.0, which saw massive tariffs being imposed across all countries, followed by a series of de-escalation and escalation at the whim of the president’s tweet.

Following the trade escalation, we’ve also seen a heightened sense of political and societal instability across the world, with more governments adopting a protectionist stance while re-arming themselves militarily following the increasing military involvement and verbal indirect threats across different regions.

The problem right now for all of us is that the old rules that govern the way global trade and geopolitics operate are not valid anymore, but at the same time, the new rules are yet to be written.

In this article, we’ll run through

1. Portfolio fund performances

2. Explaining the price actions

3. Actions taken in 2025 and potential actions in 2026

1: Portfolio Funds Performances

At a fund level, all the funds we’ve invested in have registered positive returns in 2025, with Asian and Emerging equities leading the way, while Western/Global equities returned yet another respectable double-digit performance.

Similar to the previous years post-COVID, global investor preferences are still heavily biased towards growth (specifically Tech/AI-driven narratives) style over value-oriented investment strategies. As a result, we’ve seen value-oriented funds (Fundsmith) underperform as opposed to the index (which houses largely growth and momentum stocks favoured by investors).

**Outside of price performances, Fundsmith’s equity performance is impacted by FX losses (due to weakening of USD), which were registered on the fund level. The other funds are denominated in USD and as such, the FX losses are not registered on the fund level. If we were to examine the fundsmith’s performance in USD, the returns for 2025 are 7.95%.

I'll be working on an in-depth analysis regarding Fundsmith Equity to explain their current lacklustre performance, the rationale of the fund manager, their ongoing strategy and how it will bode into our portfolio moving into the future soon. Once completed, I'll PM yall.

For individual performances, please refer to your investment account as the return may vary depending on when you start investing and also the extent to which you followed my recommendation in the last few years.

All that being said, bear in mind, however, that a single-year performance is not meaningful, and neither would it affect our long-term, overarching strategy.

As long-term investors, we should focus on the long-term while having a good understanding of what may be causing short-term performances to identify possible opportunities or threats to our long-term performances.

Moving on, let us take a look at how the markets have performed over the past 12 months.s.

2: Explaining Price Actions

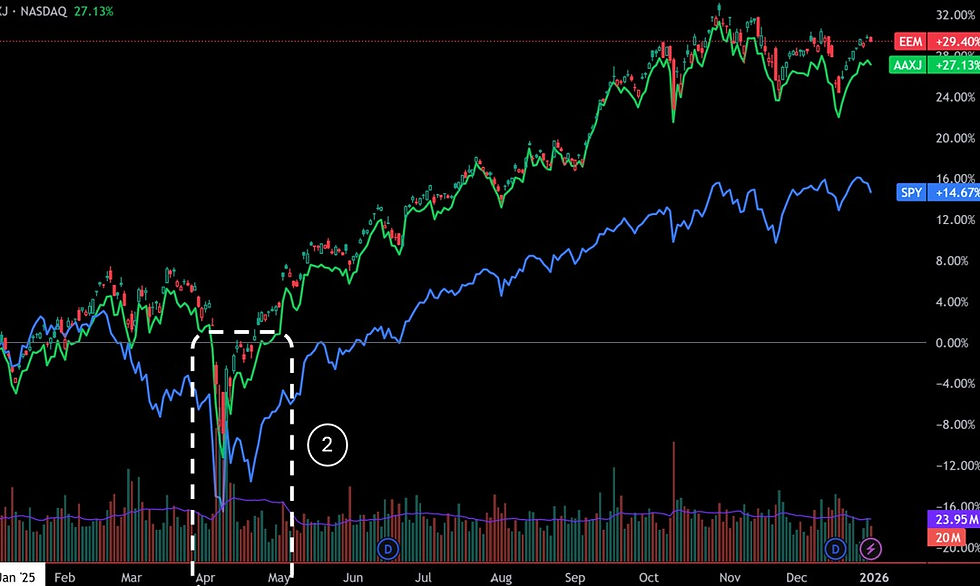

2025 can be broken down into three different segments:

Pre-Liberation Day (Before 02 April): Before the announcement of global tariffs

Liberation Month (Month of April): When Donald Trump announced the tariffs

Post-Liberation (Beyond May): After the market adjusted to Donald Trump

I’ll be using these three timelines to explain the respective behavior of the equities in the follow passages.

Pre-Liberation Day

Following a strong performance in 2024, the global markets (as represented by the S&P 500) moved largely sideways as the market remained cautious over an already richly valued market. Despite investors being cautious, there is no major catalyst to tilt the market in either direction, and the S&P 500 returned a total of -6.0% during the first quarter. That is, until liberation day.

The Asia market, on the other hand, continued its path of recovery as funds continued to flow into the region. Driven by the recovering investor confidence and the desire to diversify away from the richly valued S&P500, the MSCI Asia Ex Japan (AAXJ) and MSCI Emerging Markets (EM) saw a return of around 4.5% and 5.0% for the first quarter.

Liberation Month

On 02 April 2025, Donald Trump brought out the legendary chart that heavily undermined the old rules of how geopolitics and economics operate.

Essentially, the United States under President Donald Trump reignited trade hostilities with sweeping new tariffs. The administration imposed a universal 10% tariff on all imports, with even harsher country-specific duties – China was slapped with effective tariffs up to 145% on its goods. These “reciprocal tariffs” triggered immediate retaliation from China and rattled global supply chains.

In response to the sudden man-made uncertainty that has the potential to upend current global supply chains, the market reacted sharply by selling first and assessing the impact again later. The S&P 500, AAXJ and EM saw a sharp decline of nearly 13% to 15% in 3 days.

Having seen the impact on the equities market, the white house quickly backtracked their announcement and paused all country-specific reciprocal tariffs on 09 April 2025, just hours after they took effect that morning. As a result, the market recovered sharply, and by the end of April, all the decline that had occurred earlier was erased.

Post Liberation Day

When the backtracking occurred, the White House had essentially sent an implied message to the global markets that, as protectionist and vote-grabbing as they would like to be, they would never put the stock and bond markets at risk, and this has actually propelled the market to greater heights.

Since liberation day, there have been 5 instances in which Donald Trump attempted to escalate the tariffs/trade war, each followed by a backtrack or reversal. Every time a backtrack occurred, a pump in the equity market was followed, driven by the narrative known as the TACO trade (Trump Always Chickens Out).

This reinforced an already strong buy-the-dip momentum as investors are now operating under the belief that the government would not let the market dip for too long and would do whatever they could to ensure a recovery in share prices.

Couple this narrative/belief with the commencement of the interest rate cut by the Federal Reserve and the cessation of quantitative tightening by the end of 2025, the United States has essentially fostered a perfect environment for speculation driven by a false perception of a governmental backstop and the reintroduction of the cheap money era.

As a result, the global markets continued to be propelled to greater heights post-liberation while the positive investor confidence and sentiment continued to serve as a good driver for recovery in the Asian markets.

3: Actions Taken & Potential Actions Ahead

With all that being said and done, let us examine what actions were taken this year and potentially what actions could you expect moving into 2026.

iFast Portfolio

For the iFast portfolio, no action was taken in 2025 as the current portfolio design and structure are already well-positioned for achieving our long-term investment objectives, given the changes that were made back in October 2023.

Outside of structural changes, a portfolio rebalancing will be conducted in the first week of January.

FPI Portfolio

For the FPI portfolio, no action was taken in 2025 as the current portfolio design and structure are already well-positioned for achieving our long-term investment objectives given the changes that were made back in October 2024.

In October 2024, I decided to further diversify our Asian equity exposure into two separate funds with different management styles (Growth and Value). This was done to further reduce the impact of management risk and investor preferences during different periods where one investment style may be more preferred than the other.

For those that may have forgotten, I’ve documented the basis and logic behind the trade in the following two articles which I would assume that all of you had read before approving my trade in October.

Outside of structural changes, a portfolio rebalancing will be conducted in the first week of January.

Moving forward, I may be making an amendment to the portfolio allocation between the S&P 500 and Fundsmith to achieve a balance of 30% allocation per fund instead of the current allocation rate.

The rationale for this would be to achieve a balance between value and growth-oriented investment style (similar to what we’ve previously done for the Asian equities) as recent years have shown me the irrationality of investor preferences during different periods which have strong implications on short-term returns.

That said, given the current valuations, it wouldn’t make sense for the changes in allocation to be effected now, as we would essentially be selling off a defensive, reasonably valued fund with strong underlying fundamentals (Fundsmith) to buy a highly concentrated and overvalued index (S&P500), in a time where investor sentiment might be shifting to avoid over concentration in the AI narrative.

I will be monitoring the developments moving into 2026 and will initiate the changes when valuations have somewhat normalised between both funds.

Final Message

In a market where logic and fundamentals don’t prevail, it is important for us to ensure that our underlying investments are sound, healthy and adequately diversified to be able to ride through any extreme ups and downs that may follow when the current AI narrative unravels.

Read more: 2026 Market Outlook - High Risk High Reward

In such markets, if you do not have any better use of your funds, it is not advisable to sit out of the market as the popular proverb goes – The market can remain irrational longer than you can remain solvent.

Should logic and fundamentals prevail, any rational investor would have sat out of the global market since 2024 of which he or she would have missed out on significant gains since then.

That being said, given that timing the market is impossible, what we can do is to continue our disciplined approach towards investing in the market via Dollar Cost Averaging, focus on longer duration investments and manage our investment allocation/strategies accordingly as we progress towards our financial goals.

Stay safe and I’ll see you again during our annual review.

Daniel is a Certified Financial Planner (CFP®) and a licensed Financial Advisor by MAS.

Connect with me on social media platforms to receive updates on future content! You can also slide into my DMs if you have any questions :)

Disclaimer:

This article is meant to be the opinion of the author

This article is for information purposes only

This article should not be seen as financial advice

This advertisement has not been reviewed by the Monetary Authority of Singapore

![[Portfolio Updates] Fundsmith Equity: What's Next?](https://static.wixstatic.com/media/5dc7f7_4284779b2e1148219b3de63a154af0d0~mv2.png/v1/fill/w_443,h_250,fp_0.50_0.50,q_35,blur_30,enc_avif,quality_auto/5dc7f7_4284779b2e1148219b3de63a154af0d0~mv2.webp)

![[Portfolio Updates] Fundsmith Equity: What's Next?](https://static.wixstatic.com/media/5dc7f7_4284779b2e1148219b3de63a154af0d0~mv2.png/v1/fill/w_243,h_137,fp_0.50_0.50,q_95,enc_avif,quality_auto/5dc7f7_4284779b2e1148219b3de63a154af0d0~mv2.webp)

![[Portfolio Updates] 2025 Portfolio Review](https://static.wixstatic.com/media/5dc7f7_4b72a9e6866f4b5ca7e866ab26a91592~mv2.png/v1/fill/w_443,h_250,fp_0.50_0.50,q_35,blur_30,enc_avif,quality_auto/5dc7f7_4b72a9e6866f4b5ca7e866ab26a91592~mv2.webp)

![[Portfolio Updates] 2025 Portfolio Review](https://static.wixstatic.com/media/5dc7f7_4b72a9e6866f4b5ca7e866ab26a91592~mv2.png/v1/fill/w_243,h_137,fp_0.50_0.50,q_95,enc_avif,quality_auto/5dc7f7_4b72a9e6866f4b5ca7e866ab26a91592~mv2.webp)

Comments