Turning Your Savings Into Reliable Income Streams For Your Retirement

- Daniel Lee

- Aug 18, 2025

- 7 min read

**Best Viewed On PC**

While the topic of Retirement Planning might seem intimidating to most, the actual logic behind how we can approach the design of our retirement plan is seemingly simpler than what the majority makes it out to be.

In this article, I’ll share with you the basics of retirement planning as well as the instruments that are readily available at your disposal. The article will be broken down into different segments:

1: Defining Retirement

Before we begin, let us define what constitutes “Retirement”.

For our discussion, having the ability to retire essentially means that excluding the income from your day job, you have other sources of income that can offset the entirety of your expenses. (A.K.A. Financial Freedom)

In other words, whether you would like to continue working is irrelevant to the topic of retirement planning. The base assumption is that you do not have an active income from a full-time job.

With that out of the way, let us move into the next section on understanding the basic logic behind the design of a sustainable retirement portfolio.

2: The Key Pieces Of Your Retirement Portfolio Design

At the end of the day, the topic of Retirement Planning is about answering the question of:

“Where is the money coming from to offset the essential and discretionary expenses?”

Like piecing a puzzle, designing your own retirement portfolio requires you to match the right financial instruments and the right approach for the respective type of expenses.

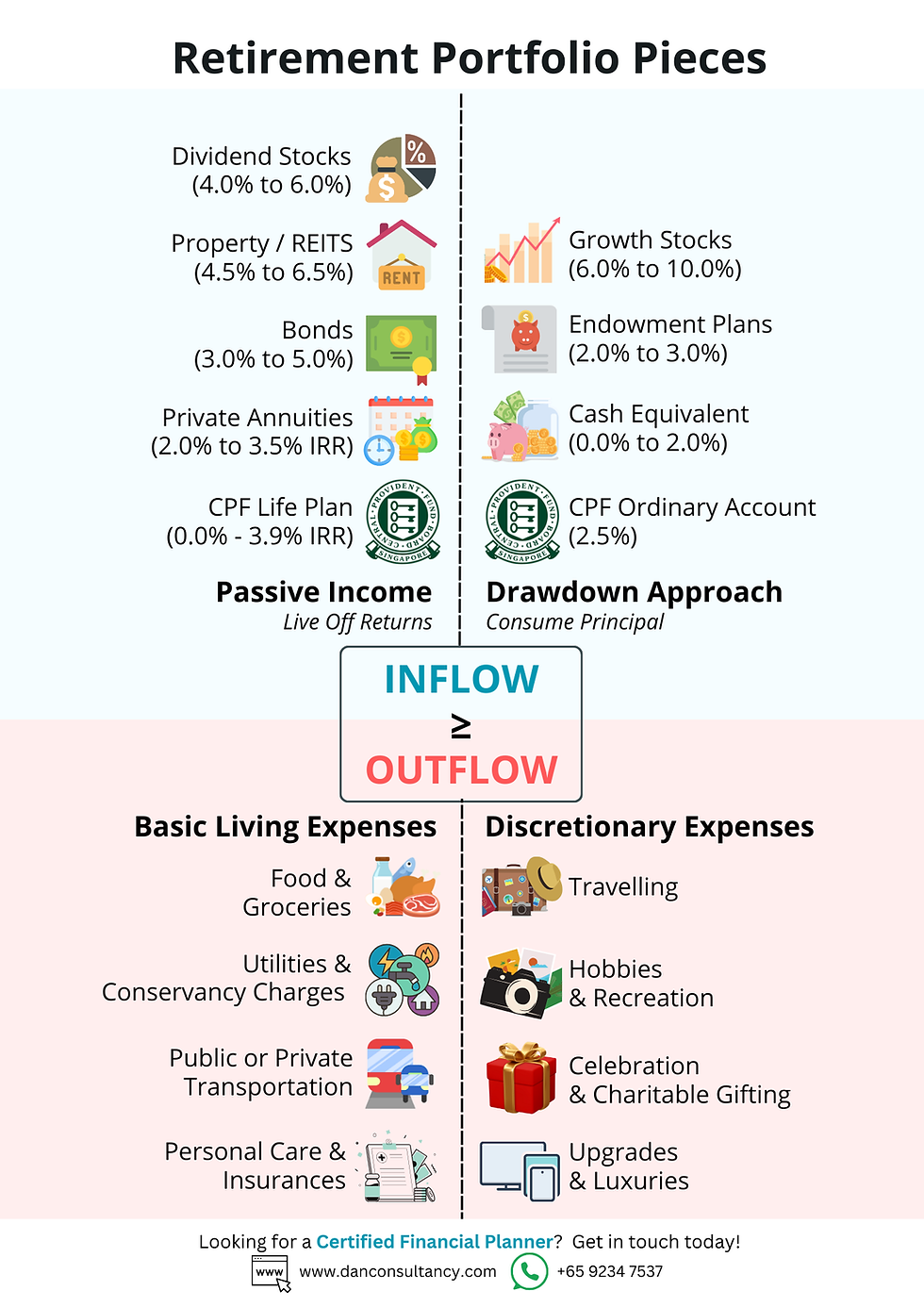

To start with the end in mind, here’s a visualisation of how your retirement portfolio design would look:

Let us break down each of these segments for you to have a better understanding of the individual pieces of the puzzle starting with:

2.1 Passive Income v.s. Drawdown Approach

When it comes to the provision of cash inflow, there are two types of cash inflow that you can receive from the different types of financial instruments.

If the capital permits, the ideal approach in designing a retirement portfolio is to adopt the passive income approach that your capital is preserved across your lifetime thereby reducing the longevity risk while enabling you to create generational wealth that can be passed down to your future generations.

What is more likely, however, is a hybrid between the drawdown approach and passive income approach given the limited capital that an average Singaporean would have for the purpose of their retirement.

I’ll elaborate more in terms of how I would adopt a hybrid approach when designing our retirement portfolio in the next segment.

2.2 Types of Financial Instruments

When it comes to the financial instrument available that will form up the basic pieces of our retirement portfolio design”

Each of the asset types listed in the table plays a different role in your retirement plan. Knowing their characteristics will help you decide where they fit in your “retirement puzzle.”

Cash & Cash Equivalents (1% – 2%, Risk-Free) This includes savings accounts, fixed deposits, and Singapore Savings Bonds. They are liquid and safe, but returns are low, so they work best for emergency funds or near-term spending.

Investment Grade Bonds (3% – 5%, Low to Medium Risk) High-quality corporate or government bonds provide predictable interest income with moderate risk. They are less volatile than stocks, making them suitable for funding essentials.

CPF Ordinary Account (2.5%, Risk-Free) Offers guaranteed returns backed by the Singapore Government. Funds here are safe but not as liquid, so they’re often best for medium-term needs or to be drawn down for discretionary expenses.

Annuities (2.5% – 3.5%, Low Risk) Insurance products that pay a fixed stream of income for a set period or for life. They can help cover fixed essential costs, reducing the stress of market fluctuations.

CPF LIFE (IRR varies, Risk-Free) – Compulsory A national lifelong annuity that pays monthly for as long as you live, backed by the government. Like it or not, the participation of CPF life is compulsory and the payout age is fixed at earliest 65 years old. As such, you can consider CPF life to be the fixed piece in the puzzle that you cannot shift.

Residential Property Investment (2.5% – 3.5%, Medium Risk)

Renting out a residential property can provide steady rental income, though net rental yields in Singapore are modest relative to property values. Unlike other forms of financial instruments, investing in a residential property is very illiquid and the cost associated with the maintenance of the asset is high.

Real Estate Investment Trusts (REITs) (5% – 6%, Medium Risk) Listed entities that invest in income-generating properties. They distribute most of their rental income as dividends, offering attractive yields but with some price volatility given the securitization nature of the instrument.

Dividend Stocks (4% – 6%, Medium Risk) Shares of companies that pay regular dividends. They can provide a steady income stream and potential capital appreciation, though market prices can fluctuate.

Growth Stocks (7% – 10%, High Risk) Companies that reinvest earnings for expansion rather than paying dividends. They can deliver higher returns but are volatile, making them more suited for the drawdown pot or long-term growth.

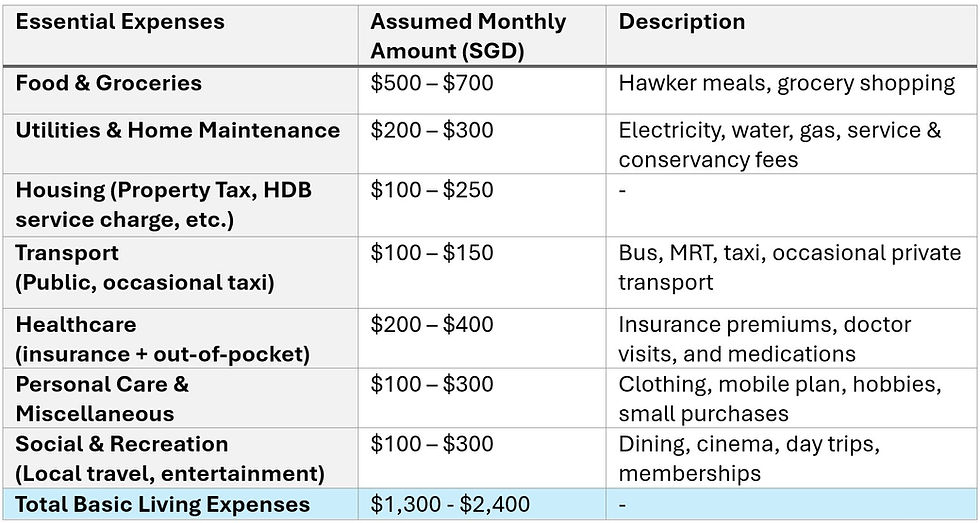

2.3 Types of Expenses

Regardless of the type of lifestyle you live, all of our expenses can be broken down into two categories:

Essential expenses that are non-negotiable and required for sustaining our basic life

Discretionary expenses that are associated with our desired lifestyle which are optional

Now that you’ve understood the different pieces to the retirement planning puzzle, let's head over to the next segment where I’ll elaborate more in terms of what a reasonable retirement portfolio design would look like for a typical average Singaporean.

3: Building The Hybrid Retirement Portfolio

Assuming that the average Singaporean would have an average net worth of around $1,000,000 around their desired retirement age with around 35-45% of it being taken up by an unproductive residential property, a typical Singaporean would be left with around $550,000 to $650,000 in return generating assets.

Assuming that the typical Singaporean have achieved the Full Retirement Sum ($213,000 As At 2025), this would mean that he or she would have a total of around $337,000 to $437,000 that could be deployed at his or her discretion into the different types of financial instruments of his or her choice.

With such a limited amount of capital, it is almost impossible for a typical Singaporean to build their retirement portfolio solely using the passive income approach as the income generated would not be sufficient to provide for a basic level of retirement lifestyle (especially so if you’re retiring before 65 when the CPF Life starts to payout.

As such, a combination of both the drawdown approach and the passive income approach would be necessary to ensure that your retirement portfolio can outlive your life while providing you with the standard of lifestyle you would like to enjoy despite the limited capital that you have.

Putting everything together, here’s what a typical design would look like:

3.1. Essential Expenses (Core)

Purpose: Cover the most basic, non-negotiable costs of living.

Funding Source:

CPF LIFE Payouts: A guaranteed, lifelong monthly income from age 65 onward.

If the desired retirement age is before age 65, you could adopt a drawdown approach to cover the gap and replicate the cashflow behaviour of the CPF Life payout.

Why This Matters: This ensures you’ll always have a secure baseline income, regardless of how long you live or how the markets perform.

3.2. Additional Essential Expenses

Purpose: To supplement CPF LIFE payouts if they don’t fully cover your essentials.

Recommended Funding Source:

Dividends from REITs and dividend stocks

Interest from investment-grade bonds

Private annuities

Why This Matters: As these income streams are relatively stable, matching them to essential costs allows you to ensure the longevity of your retirement portfolio as the capital will be preserved while providing you with the income you need for your basic living expenses.

3.3 Discretionary Expenses

Purpose: Fund the lifestyle choices that make retirement enjoyable — travel, hobbies, gifts, upgraded dining, and technology.

Funding Source:

Selling units of growth stocks during favourable market conditions

Drawing down from cash savings or non-core assets

Why This Matters: Discretionary spending can be scaled up or down depending on your financial situation and the market conditions. Doing so ensures that you will always spend within your means.

3.4 Hospital Expenses

Purpose: Protect against large, unexpected hospital bills.

Funding Source:

Integrated Shield Plans covering MOH-approved medically necessary treatments.

Riders to provide for and limit your out-of-pocket expenses

Why This Matters: Without proper medical coverage, a single hospital stay can deplete your retirement portfolio and potentially force you out of your retirement. Having a complete shield plan coverage (main plan + rider) would provide you with the sense of comfort and certainty that your retirement would be secured regardless of any critical illness conditions to come.

3.5. Long-Term Care Expenses

Purpose: Provide for the additional costs of long-term care services if you become severely disabled.

Funding Source:

CareShield Life payouts

Careshield Life Supplement Payout

Why This Matters: Long-term care can be one of the most financially draining risks in late retirement that many of us tend to overlook. Having a long-term care insurance ensures that any additional long-term care expenses would be provided for without having to draw down on your retirement portfolio which may force you out of your retirement when you are in a worse physical condition.

Read more: 3 Minute Crash Course on CareShield Life

4: Bringing It All Together

By designing your retirement portfolio in such a structure, you ensure that:

Your essentials are bulletproof — CPF LIFE plus stable passive income handle your baseline costs for life. This ensures your day-to-day expenses are provided for regardless of market conditions and regardless of how long you will live.

Your lifestyle is flexible — discretionary spending comes from assets that can grow over time but can also be paused if markets underperform.

Your health and care are protected — hospital and long-term care plans will shield you from catastrophic expenses, thereby ensuring that your retirement longevity is not jeopardised by any potential health issues during your later years.

By allocating your assets to match these categories, you create a retirement portfolio that is resilient, adaptable, and sustainable — regardless of how long you live or how markets behave.

If you need guidance on where to begin your financial planning journey, let’s have a conversation:

If you want to learn more about how you can kick start your journey to achieve financial freedom, you can download my eBook for a step-by-step guide:

Daniel is a Licensed Independent Financial Consultant with MAS and a Certified Financial Planner (CFP®).

Connect with me on social media platforms to receive updates on future content! You can also slide into my DMs if you have any questions :)

Disclaimer:

This article is meant to be the opinion of the author

This article is for information purposes only

This article should not be seen as financial advice

This advertisement has not been reviewed by the Monetary Authority of Singapore

![[Portfolio Updates] Fundsmith Equity: What's Next?](https://static.wixstatic.com/media/5dc7f7_4284779b2e1148219b3de63a154af0d0~mv2.png/v1/fill/w_443,h_250,fp_0.50_0.50,q_35,blur_30,enc_avif,quality_auto/5dc7f7_4284779b2e1148219b3de63a154af0d0~mv2.webp)

![[Portfolio Updates] Fundsmith Equity: What's Next?](https://static.wixstatic.com/media/5dc7f7_4284779b2e1148219b3de63a154af0d0~mv2.png/v1/fill/w_243,h_137,fp_0.50_0.50,q_95,enc_avif,quality_auto/5dc7f7_4284779b2e1148219b3de63a154af0d0~mv2.webp)

![[Portfolio Updates] 2025 Portfolio Review](https://static.wixstatic.com/media/5dc7f7_4b72a9e6866f4b5ca7e866ab26a91592~mv2.png/v1/fill/w_443,h_250,fp_0.50_0.50,q_35,blur_30,enc_avif,quality_auto/5dc7f7_4b72a9e6866f4b5ca7e866ab26a91592~mv2.webp)

![[Portfolio Updates] 2025 Portfolio Review](https://static.wixstatic.com/media/5dc7f7_4b72a9e6866f4b5ca7e866ab26a91592~mv2.png/v1/fill/w_243,h_137,fp_0.50_0.50,q_95,enc_avif,quality_auto/5dc7f7_4b72a9e6866f4b5ca7e866ab26a91592~mv2.webp)

Comments