[Market Updates] 2025 Quarter 2

- Daniel Lee

- Jul 7, 2025

- 5 min read

If there’s one word to summarise the second quarter of 2025, the word would be: War.

In the span of three months, we’ve seen the United States launch its global trade war across all its trading partners, friends or foes. We’ve also seen a significant escalation of fighting within the Middle East, further escalated by the United States’ decision to bomb Iran’s nuclear facilities.

In this article, we’ll look into the three big themes that have transpired in the second quarter in 2025 which will have dramatic impact on the markets in the later half of this year.

Conflict Escalation: Israel + US v.s. Iran

The Middle East entered a dangerous new phase in June 2025 as open conflict erupted between Israel and Iran.

The hostilities began with Israeli strikes on Iran’s nuclear and military infrastructure, prompting a retaliatory barrage of hundreds of missiles and drones from Iran toward Israel, some of which penetrated Israel’s sophisticated air defences.

The United States intervened decisively, launching "Operation Midnight Hammer"—airstrikes targeting three of Iran’s key nuclear sites, which U.S. President Donald Trump declared “completely and fully obliterated.” The U.S. warned of further strikes if Iran retaliates.

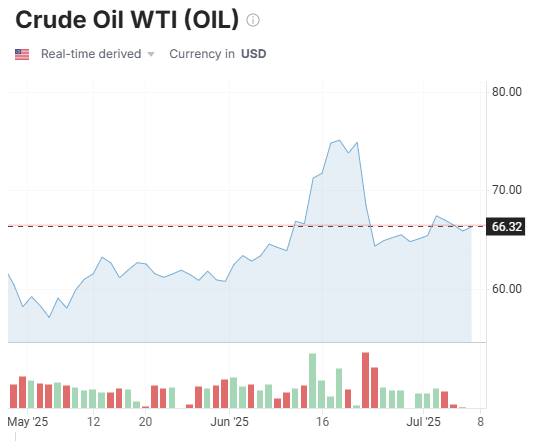

The immediate market response was a sharp rise in oil prices as investors braced for potential disruptions to global energy supplies.

Analysts warn that if Iran retaliates by disrupting key trade routes or targeting oil infrastructure, oil prices could surge further, with worst-case scenarios projecting prices as high as $130 per barrel. Such a spike would drive up energy costs across the economy, increasing inflation and potentially pushing U.S. inflation close to 6% by year-end.

Since a “cease fire” has been placed in force, the price of crude oil has come back down to its previous levels. That said, looking at the developments in the area, it is not unlikely that the sparks of future conflict re-open the possibility of a larger-scale war.

Why does it matter? (Negative)

Higher oil prices translate directly into higher input costs for businesses and consumers, squeezing profit margins and reducing discretionary spending.

Inflationary pressures could delay or prevent central banks from cutting interest rates, tightening financial conditions and increasing market volatility. Investors should monitor developments closely, as further escalation could trigger risk-off sentiment, a flight to safe-haven assets, and sustained pressure on equities.

US: Trade War Pause Masks Looming Cost Pressures

Following a series of aggressive tariff announcements from April onward, the U.S. has engaged in a broad-based trade war, with tariffs as high as 145% imposed on Chinese imports and significant duties placed on goods from other countries. While a 90-day pause on some tariffs was negotiated in May, this reprieve is set to expire on 09 July with no comprehensive trade deal in sight.

Despite these headwinds, U.S. economic data has remained resilient. However, the full impact of tariffs has yet to filter through to the economy. As inventories deplete and businesses are forced to restock at higher prices due to tariffs, cost pressures will intensify. The situation is further complicated by rising energy prices stemming from the Middle East conflict, which could compound inflationary pressures in the second half of the year.

In response to this, the Federal Reserve have held its stance steady with an anticipated 2 rate cuts in the second half of the year in anticipation of a higher inflation rate environment.

Why does this matter? (Negative)

The delayed impact of tariffs and higher energy costs means that inflation and cost pressures may rise significantly in the coming months, potentially eroding corporate margins and consumer purchasing power.

The combination of trade uncertainty and energy price volatility could weigh on business confidence and investment, with long-term effects including slower GDP growth and higher unemployment rate.

While this may force the Federal Reserve to start cutting its rates, likely, the lowered borrowing cost would only be able to mitigate the higher cost pressures driven by the ongoing wars that the United States is seemingly fighting.

Investors should remain cautious, as the current resilience in economic data may not fully reflect the risks ahead.

Asia: Invesotrs Pivot To Asia For Safety

Amid escalating U.S. trade tensions and Middle East volatility, investors are accelerating capital rotation toward Asian markets. Throughout the second quarter of 2025, we’ve seen billions of outflow from US equity funds while Asian equity funds experienced positive inflows. This divergence further intensified in June 2025.

Concurrently, foreign demand for U.S. Treasuries is eroding. Foreign investors reduced holdings by over $60 billion since April, with participation in the latest 20-year Treasury auction hitting a five-year low. Custodial holdings (foreign central bank reserves at the Fed) plunged $48 billion since March, signalling declining confidence in dollar assets despite traditional safe-haven demand during dollar weakness.

Such a behaviour is unprecedented as in times of heightened uncertainty, the United States would often experience huge inflows as they are perceived as a safe haven. However, with the recent events and a rising concern over the lack of fiscal prudence, the previous perception of the United States have been significantly eroded which resulted in funds flowing to other areas in seek of further diversification.

Why does this matter? (Positive)

This capital shift underscores Asia’s emergence as a stability anchor. As trade wars and Treasury volatility disrupt U.S. markets, Asia offers:

Diversification benefits through deepening regional supply chains and intra-Asian trade integration

Attractive valuations compared to U.S. equities

Currency tailwinds from capital inflows strengthening Asian currencies

The structural unwind of Asia’s $7.5 trillion bet on U.S. assets now fuels a self-reinforcing cycle: Capital redeployment builds regional resilience, making Asia increasingly insulated from Western volatility while offering investors a strategic hedge against U.S.-centric risks.

While the impacts will not be felt immediately in the short term, the recent developments are without a doubt a positive step for Asia in the long term. In the short term, hopefully, the rotation from Western markets to Asia markets will even out the valuation differences between both markets and serve as a strong catalyst for higher confidence in the region.

Long Story Short

Despite the major disruption experienced back in April, the market have essentially wrote off Donald Trump’s trade war threat with a new phrase: Trump Always Chickens Out (TACO) leading the recovery in the markets as they are pricing in a complete reversal in Trumps threats.

Regardless of whether Trump’s chickens out, what is undeniable is the damage that Trump has done to the credibility of the United States which has spearheaded the need and demand to diversify away from the United States.

This is evident in the price actions of the market with the MSCI AC Asia Pacific Index registering around 15% upside while the S&P 500 registering a 3% upside.

That being said, the downside risk of a US recession should not be underestimated. As the saying goes: “When America sneezes, the world catches a cold”. Should a recession materialize, the downside pressure from the US may well cancel out the upside recovery experienced in Asia.

Regardless of what may materialize in 2025, the course of action for us as investors remains unchanged – and that is to focus our attention on what is to be in the next 10-15 years and not be distracted by the temporary distortion in the economy and markets.

Hopefully, the market will normalise without any major economic crisis. That said, only time will tell.

Read more: 2025 Market Outlook: The Age Of Tariffs

As usual, if you have any questions, you can PM me anytime. If not, I’ll catch you on our annual review.

Daniel is a Licensed Financial Consultant with MAS and a Certified Financial Planner (CFP®).

Connect with me on social media platforms to receive updates on future content! You can also slide into my DMs if you have any questions :)

Disclaimer:

This article is meant to be the opinion of the author

This article is for information purposes only

This article should not be seen as financial advice

This advertisement has not been reviewed by the Monetary Authority of Singapore

![[Portfolio Updates] Fundsmith Equity: What's Next?](https://static.wixstatic.com/media/5dc7f7_4284779b2e1148219b3de63a154af0d0~mv2.png/v1/fill/w_443,h_250,fp_0.50_0.50,q_35,blur_30,enc_avif,quality_auto/5dc7f7_4284779b2e1148219b3de63a154af0d0~mv2.webp)

![[Portfolio Updates] Fundsmith Equity: What's Next?](https://static.wixstatic.com/media/5dc7f7_4284779b2e1148219b3de63a154af0d0~mv2.png/v1/fill/w_243,h_137,fp_0.50_0.50,q_95,enc_avif,quality_auto/5dc7f7_4284779b2e1148219b3de63a154af0d0~mv2.webp)

![[Portfolio Updates] 2025 Portfolio Review](https://static.wixstatic.com/media/5dc7f7_4b72a9e6866f4b5ca7e866ab26a91592~mv2.png/v1/fill/w_443,h_250,fp_0.50_0.50,q_35,blur_30,enc_avif,quality_auto/5dc7f7_4b72a9e6866f4b5ca7e866ab26a91592~mv2.webp)

![[Portfolio Updates] 2025 Portfolio Review](https://static.wixstatic.com/media/5dc7f7_4b72a9e6866f4b5ca7e866ab26a91592~mv2.png/v1/fill/w_243,h_137,fp_0.50_0.50,q_95,enc_avif,quality_auto/5dc7f7_4b72a9e6866f4b5ca7e866ab26a91592~mv2.webp)

Comments